Which altcoin will be next ET

We all know that in 2024 Bitcoin was the star of the show as its spot ETFs launched in the United States. But what if we told you that the whole crypto market could be about to go parabolic in 2025.

That’s because a whole range of altcoins are on track to get their own ETFs, and this could send the market into overdrive and push prices up towards Valhalla.

Get an email whenever Dominalt publishes.

Get an email whenever Dominalt publishes. By signing up, you will create a Medium account if you don’t already have…

Before we begin, let me be clear no financial advice will be given here. We’re here to help you on your crypto quest, but it’s up to you to decide what is best. Crypto is a ride it’s wild and unsteady, so research well to make sure you’re ready.

The ETF Progress So Far

Now, as you’ll know, these spot Bitcoin ETFs have been a major success since they were approved by the Securities and Exchange Commission back in January 2024. Now this is one of the many bullish catalysts that 2024 threw up and was arguably the one that sent BTC soar into new all time highs.

We also saw the approval of spot Ethereum ETFs, which began trading in July after the SEC quite unexpectedly gave them the thumbs up too. However, the Ethereum ETFs haven’t enjoyed the same success, and at the time of shooting ETH has yet to reclaim its previous all time high of around $4,900.

There are a few reasons for this with the most obvious being the large outflows from Grayscale converted Ethereum Trust. But at a more fundamental level, Bitcoin is much easier for institutional investors to wrap their heads around than Ethereum is. And that’s because BTC has a very simple narrative, digital gold. Conversely, ETH is the gas token that powers a global virtual computer that features smart contract enabled dApps. A little more advanced, whatever the reason, though the spot Ethereum ETFs have not met the expectations that institutional investors would flock to ETH to enjoy the many layers of potential it has to offer. No Layer-2 pun intended.

In fact, it wasn’t until November when the spot Ethereum ETFs began gaining momentum, and that’s likely because of two things, Donald Trump’s presidential election victory and Gary Gensler subsequently stepping down as the chairman of the SEC. More on that a bit later.

In any case, the Ethereum ETFs marked the first time and altcoin got such royal treatment in this context, and has since had everyone wondering which one is next. Luckily, Eric Balchunas, a senior ETF analyst from Bloomberg, he has the answers.

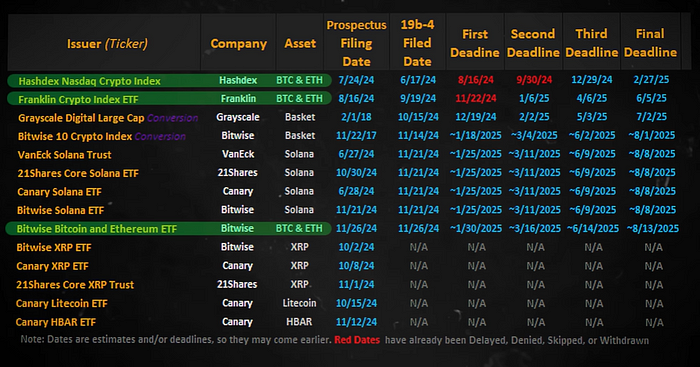

As of November 2024 there were 14 penned in ETF applications. This list includes three dual ETFs that incorporate both Bitcoin and Ethereum, and they were submitted by hashtags, Franklin Templeton and Bitwise.

And there’s also two so called baskets including conversions from Grayscale large cap Trust and Bitwise’s 10 crypto index. And for anyone wondering, Grayscale large cap Trust features BTC, ETH, XRP SOL and AVAX. Meanwhile, Bitwise’ 10 crypto index features BTC eth, XRP, SOL, ADA, AVAX, LINK, DOT, BCH and of course, NEAR.

Anyway, there are also four standalone ETF applications for Solana submitted by VanEck, 21Shares, Canary Capital and Bitwise. There are three for XRP from Bitwise, 21Shares and Canary. And interestingly, Canary is the only one to have submitted ETF applications for Litecoin and Hedera. Since that tweet was posted at the end of November, the SEC has approved two of the three Bitcoin and Ethereum, dual ETFs, specifically the ones from Hashdex and Franklin Templeton.

Now this approval happened just nine days after Hashdex’s third deadline, the first deadline for Bitwise is dual ETF is at the end of January. So, logically this would be the next one to get approved, especially since the other two have already been given the thumbs up.

As for Solana, the SEC reportedly intends to reject two of the sole ETF applications. And what’s more is that they’ve also signaled their intention to pause new ETF applications under the current administration. Looks like a bit of a snark from Gary on his way out, if you ask me.

Nevertheless, WisdomTree has since filed for an ETF application for XRP, and Grayscale has filed for a sole ETF too, suggesting they believe approvals will come eventually, and who knows there are probably more filings by the time you’re reading this article that, speaking of which.

Move Over Gensler, It’s Time For A New Chairman

Now, while the SEC will probably ignore any new ETF applications under this administration, this doesn’t slow things down too much, and that’s because following Donald Trump’s presidential election victory, SWC Chairman Gary Gensler is finally stepping down on the 20th of January, the same day as Trump’s inauguration.

And just as we’ll be cheering his departure, we’ll also be cheering the arrival of his replacement, Paul Atkins. For those unfamiliar, Paul actually served as a member of the President’s strategic and Policy Forum in the Trump first term. In that time, he was recognized for promoting common sense regulations and advising against regulation that created unnecessary obstacles. He also happens to be pro crypto. You can think of him as the Yin to Gary Gensler Yang.